Embark on a journey to discover the ins and outs of selecting the ideal Shopify Capital Loan for your ecommerce venture. From understanding the basics to exploring key considerations, this guide is your gateway to financial growth and success.

Delve deeper into the world of ecommerce financing as we unravel the mysteries behind choosing the right capital loan for your business.

Introduction to Shopify Capital Loans

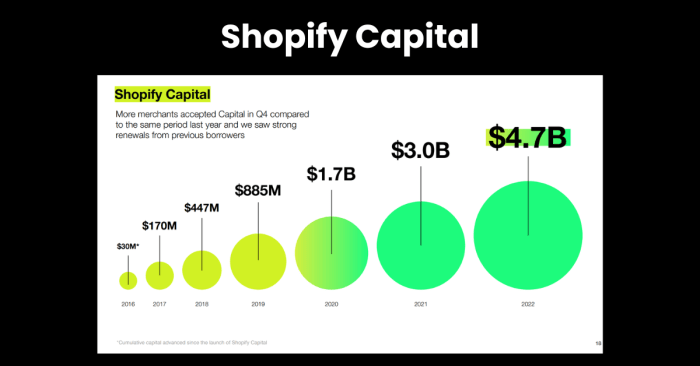

A Shopify Capital Loan is a financing option specifically designed for ecommerce businesses that operate on the Shopify platform. It provides these businesses with access to capital to help them grow and expand their operations.

When it comes to choosing the right loan for your ecommerce growth, it is essential to understand the eligibility criteria and how it can benefit your business in the long run. Let's explore these aspects in more detail.

Eligibility Criteria for Applying for a Shopify Capital Loan

Before applying for a Shopify Capital Loan, ecommerce businesses need to meet certain eligibility criteria. These criteria typically include:

- Being a Shopify merchant

- Having a minimum sales threshold

- Having a positive payment history

- Meeting other specific requirements set by Shopify

Importance of Choosing the Right Loan for Your Ecommerce Growth

Choosing the right loan for your ecommerce growth is crucial for the success of your business. It can impact your ability to expand, invest in marketing, improve your operations, and ultimately increase your revenue. Factors to consider when selecting a loan include:

- Interest rates and fees

- Loan terms and repayment schedule

- Flexibility in fund usage

- Impact on cash flow

Factors to Consider When Choosing a Shopify Capital Loan

When deciding on a Shopify Capital Loan for your ecommerce growth, there are several important factors to take into consideration. From the types of loans available to the interest rates and repayment terms, each aspect can impact your business's financial health and success.

Types of Shopify Capital Loans

- Shopify Merchant Cash Advance: This type of loan provides a lump sum of cash upfront, which is then repaid through a percentage of your daily sales on Shopify.

- Shopify Business Loan: A traditional loan with a fixed repayment schedule and interest rate, ideal for larger investments in your ecommerce business.

- Shopify Revenue Based Financing: This loan option allows you to repay the loan based on a percentage of your monthly revenue, providing flexibility in repayment.

Interest Rates Associated with Shopify Capital Loans

- Interest rates for Shopify Capital Loans can vary depending on the type of loan and your business's financial health.

- Merchant Cash Advances typically have higher interest rates due to the convenience and flexibility they offer.

- Business Loans and Revenue Based Financing may have lower interest rates, but it's essential to compare offers and terms to find the best option for your business.

Repayment Terms and Conditions for Shopify Capital Loans

- The repayment terms for Shopify Capital Loans can range from a few months to several years, depending on the loan amount and type.

- Merchant Cash Advances have daily repayments based on a percentage of your sales, providing flexibility but potentially impacting cash flow.

- Business Loans and Revenue Based Financing have fixed monthly repayments, making it easier to plan and budget for loan repayment.

Assessing Your Ecommerce Needs

Before applying for a Shopify Capital Loan, it is crucial to assess your ecommerce business needs to determine where additional capital could drive growth. By identifying key areas that require investment, you can make informed decisions to help your business thrive.

Identify Key Areas for Investment

When assessing your ecommerce needs, consider areas such as:

- Expanding product lines or inventory

- Improving website design and user experience

- Investing in marketing and advertising campaigns

- Upgrading technology and infrastructure

Setting Clear Financial Goals

Setting clear financial goals is essential before applying for a loan. Determine how much capital you need, how you plan to use it, and how it will contribute to your business growth. Having a solid financial plan in place will increase your chances of success.

Utilizing Shopify Capital Loan for Ecommerce Operations

A Shopify Capital Loan can be used in various ways to enhance your ecommerce operations, such as:

- Launching new marketing campaigns to reach a wider audience

- Optimizing your website for better performance and user experience

- Investing in inventory to meet increasing customer demand

- Expanding your product offerings to attract new customers

Comparing Different Loan Options

When considering financing options for your ecommerce business, it's essential to compare Shopify Capital Loans with traditional bank loans to make an informed decision. Each option has its advantages and disadvantages, so let's delve into the specifics.

Shopify Capital Loans vs. Traditional Bank Loans

| Criteria | Shopify Capital Loans | Traditional Bank Loans |

|---|---|---|

| Application Process | Quick and easy application process | Lengthy application process with extensive documentation |

| Approval Time | Rapid approval process | Approval can take weeks |

| Repayment Schedule | Flexible repayment options | Fixed repayment schedules |

| Collateral | No collateral required | May require collateral |

Advantages and Disadvantages of Choosing Shopify Capital Loans

- Advantages:

- Quick and simple application process

- No collateral required

- Flexible repayment options

- Disadvantages:

- Higher interest rates compared to traditional bank loans

- Lower borrowing limits

Flexibility in Repayment Schedules

Shopify Capital Loans offer flexibility in repayment schedules, allowing you to adjust payments based on your ecommerce revenue. This can be beneficial during slower months when cash flow may be tighter.

Tips for Selecting the Right Shopify Capital Loan

When it comes to choosing the right Shopify Capital Loan for your ecommerce business, there are several key factors to consider. From evaluating your needs to negotiating terms with the loan provider, here is a step-by-step guide to help you make the best decision for your business.

Evaluating Your Needs

Before you start looking at loan options, take the time to assess your ecommerce business's financial needs. Consider factors such as your revenue projections, cash flow requirements, and growth plans. This will help you determine how much capital you need and what type of loan would be most suitable for your business.

Negotiating Terms and Conditions

When choosing a Shopify Capital Loan, don't be afraid to negotiate the terms and conditions with the loan provider. You can try to negotiate the interest rate, repayment schedule, and any fees associated with the loan. Make sure you fully understand the terms before agreeing to anything, and don't hesitate to ask for clarification on any points you're unsure about.

Avoiding Common Pitfalls

There are some common pitfalls to watch out for when selecting a Shopify Capital Loan. Avoid taking on more debt than you can afford to repay, as this could put your business at risk. Additionally, be wary of loans with high interest rates or hidden fees that could end up costing you more in the long run.

Always read the fine print and make sure you fully understand the terms of the loan before signing any agreements.

Concluding Remarks

In conclusion, the path to maximizing your ecommerce potential lies in making informed decisions about capital loans. By selecting the most suitable option, you pave the way for sustainable growth and prosperity in your online business.

User Queries

What are the eligibility criteria for applying for a Shopify Capital Loan?

To be eligible, you typically need to have a certain sales history on Shopify and meet specific revenue requirements set by the platform.

How can a Shopify Capital Loan benefit my ecommerce business?

These loans offer quick access to capital, flexible repayment terms, and can be used to fuel growth initiatives like marketing campaigns or inventory expansion.

What factors should I consider when choosing a Shopify Capital Loan?

Factors such as interest rates, repayment terms, and the type of loan (like a merchant cash advance or business loan) should all be carefully evaluated.

How do I assess my ecommerce needs before applying for a loan?

Identify areas where additional capital could drive growth, set clear financial goals, and consider how a Shopify Capital Loan could enhance your operations.

What are common pitfalls to avoid when selecting a Shopify Capital Loan?

Avoid overlooking the terms and conditions, failing to negotiate for better rates, and taking on more debt than your business can handle.