Exploring the suitability of Shopify Capital Loan for small businesses opens up a world of opportunities and challenges. Let's delve into the intricacies of this financial option to understand its implications for entrepreneurs.

Detailing the concept, benefits, and application process can shed light on whether Shopify Capital Loan is the right choice for small businesses.

What is Shopify Capital Loan?

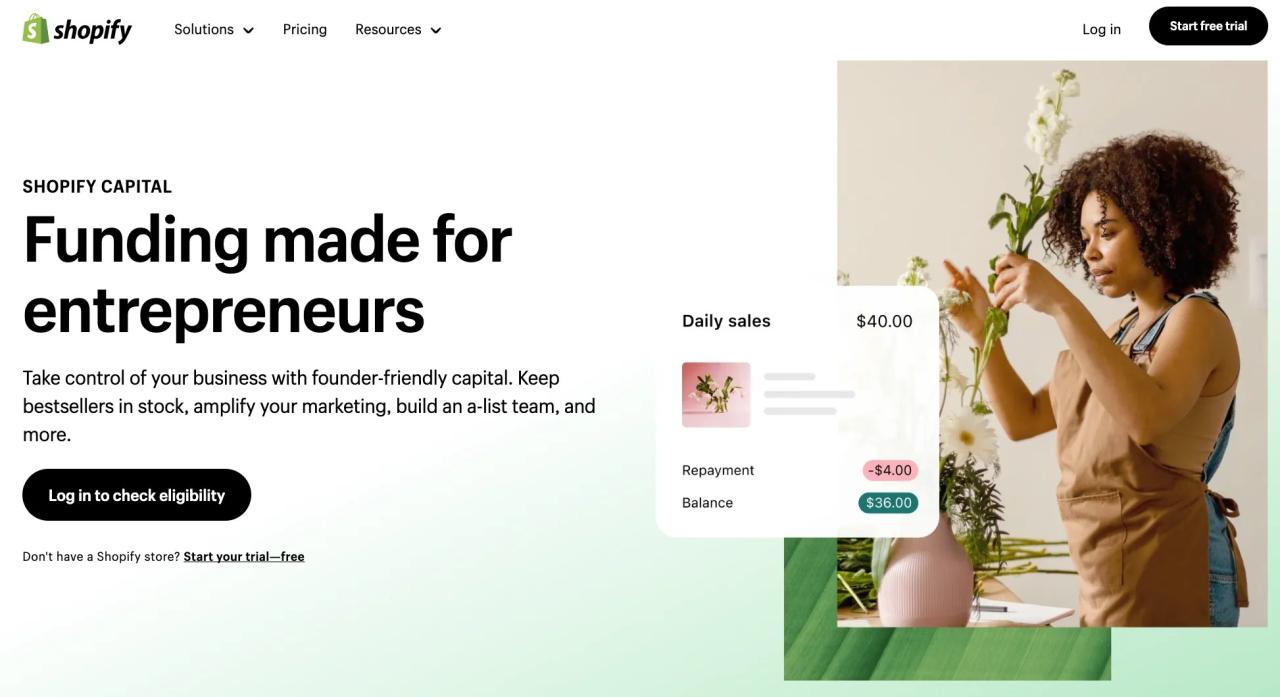

Shopify Capital Loan is a financing option offered by Shopify to help small businesses secure funding for growth and expansion. It provides eligible merchants with a lump sum of capital that is repaid through a fixed percentage of their daily sales.

How Shopify Capital Loan Works

- Shopify evaluates a business's performance on its platform to determine eligibility for a loan.

- Once approved, the business receives a lump sum of capital, which is repaid through a percentage of daily sales.

- There are no fixed monthly payments, as the repayment amount fluctuates based on sales volume.

- Businesses can use the loan for various purposes, such as purchasing inventory, expanding marketing efforts, or improving infrastructure.

Eligibility Criteria

- Businesses must be actively selling on the Shopify platform.

- Shops must have a minimum threshold of sales and history on the platform to qualify.

- Shopify evaluates factors like sales history, account health, and business performance to determine eligibility.

Benefits for Small Businesses

- Quick access to capital without the need for extensive paperwork or credit checks.

- Flexible repayment structure based on daily sales volume.

- Opportunity to invest in growth initiatives and scale the business more rapidly.

- Support from Shopify in the form of financial assistance to help businesses succeed.

Pros and Cons of Shopify Capital Loan

When considering a Shopify Capital Loan for your small business, it is essential to weigh the advantages and disadvantages to make an informed decision.

Advantages of Shopify Capital Loan

- Quick Approval: Shopify Capital Loans are known for their fast approval process, providing small businesses with access to funds when needed urgently.

- No Fixed Monthly Payments: Unlike traditional bank loans, Shopify Capital Loans are repaid based on a percentage of your daily sales, which can be beneficial during slow sales periods.

- No Personal Guarantee: In most cases, Shopify Capital Loans do not require a personal guarantee, reducing the risk for business owners.

- No Credit Check: Shopify Capital Loans do not typically require a credit check, making them accessible to businesses with less-than-perfect credit scores.

Drawbacks of Shopify Capital Loan

- Higher Fees: Shopify Capital Loans often come with higher fees compared to traditional bank loans, which can increase the overall cost of borrowing.

- Limited Loan Amounts: The maximum loan amount available through Shopify Capital may not be sufficient for larger business expenses or expansion plans.

- Short Repayment Terms: Shopify Capital Loans usually have shorter repayment terms, leading to higher daily repayment amounts that may impact cash flow.

Comparison with Traditional Bank Loans

- Benefits of Shopify Capital Loan:

- Quick Approval Process

- No Fixed Monthly Payments

- No Personal Guarantee

- No Credit Check

- Risks of Shopify Capital Loan:

- Higher Fees

- Limited Loan Amounts

- Short Repayment Terms

- Benefits of Traditional Bank Loans:

- Potentially Lower Interest Rates

- Higher Loan Amounts

- Longer Repayment Terms

- Established Relationship with Bank

- Risks of Traditional Bank Loans:

- Strict Credit Requirements

- Lengthy Approval Process

- Personal Guarantee Often Required

- Fixed Monthly Payments

Application Process and Requirements

When it comes to applying for a Shopify Capital Loan, small businesses need to follow specific steps and meet certain requirements to increase their chances of approval.

Application Process

- Log in to your Shopify account and navigate to the "Finances" section.

- Click on "Shopify Capital" and select "Apply Now" to start the application process.

- Fill out the required information, including details about your business and revenue.

- Review and submit your application for review by Shopify's underwriting team.

- If approved, you will receive a loan offer with details on the terms and conditions.

- Once you accept the offer, the funds will be deposited into your business account.

Requirements

- Minimum of 6 months in business with Shopify.

- Minimum monthly revenue threshold set by Shopify.

- Good standing with Shopify in terms of payments and account health.

- Provide business documentation such as tax returns, bank statements, and financial statements.

- Personal credit history may also be considered in the evaluation process.

Tips for Approval:

- Maintain consistent revenue and sales on your Shopify store.

- Keep your Shopify account in good standing with no outstanding issues.

- Provide accurate and up-to-date financial information during the application process.

- Work on improving your personal and business credit scores if needed.

Repayment Terms and Conditions

When it comes to repaying a Shopify Capital Loan, small businesses need to understand the various options available, as well as the associated costs and terms.

Repayment Options

- Automatic Deductions: Shopify will automatically deduct a percentage of your daily sales until the loan is repaid in full.

- Fixed Payments: You can opt for fixed daily or weekly payments to repay the loan over a specific period.

Interest Rates, Fees, and Costs

- Interest Rates: Shopify Capital Loans do not have set interest rates. Instead, a fixed fee is charged upfront, and the total repayment amount does not change.

- Fees: The fee charged is based on the amount borrowed and is deducted from the loan amount before you receive the funds.

- Associated Costs: There are no hidden costs or additional charges associated with Shopify Capital Loans.

Managing Repayments Effectively

- Monitor Cash Flow: Keep track of your sales and revenue to ensure you can cover the loan repayments.

- Plan Ahead: Create a repayment plan and budget to avoid any financial strain on your business.

- Communicate with Shopify: If you foresee any issues with repayments, communicate with Shopify to explore possible solutions or alternative arrangements.

Final Summary

In conclusion, the decision to opt for Shopify Capital Loan hinges on various factors that we've dissected. Small businesses must weigh the pros and cons carefully to make an informed choice about their financial future.

FAQ Section

What are the eligibility criteria for Shopify Capital Loan?

Eligibility criteria typically include factors like sales history, account health, and other business metrics that Shopify considers.

How does Shopify Capital Loan differ from traditional bank loans?

Shopify Capital Loan offers a streamlined application process and tailored repayment options, unlike traditional bank loans that may have stricter requirements.

Can small businesses use the loan for any purpose?

While the loan is meant to support business growth, small businesses have flexibility in how they utilize the funds to meet their specific needs.